Best Ways to Fund Your Startup (Beyond Loans)

Understanding the Core Concept

Bootstrapping, in the context of business, refers to the process of launching and growing a company using primarily internal resources and personal investment. It contrasts sharply with seeking external funding through venture capital or loans. This approach emphasizes self-reliance and often involves a high degree of personal sacrifice and dedication from the founders. Bootstrapping businesses often have a strong focus on operational efficiency and cost-cutting strategies.

The core principle of bootstrapping revolves around maximizing the use of existing resources. This could involve repurposing existing assets, optimizing workflows, or developing creative strategies to reduce expenses. It often requires meticulous planning and a deep understanding of the target market and the business model.

Strategies for Success

Successful bootstrapping often hinges on a strong understanding of the market and a well-defined business strategy. Founders need to identify specific needs within the market and develop a solution that addresses those needs effectively. This involves careful market research and a thorough understanding of competitor offerings.

Cost-cutting measures are crucial. Efficient resource allocation, negotiating favorable deals with suppliers, and minimizing overhead expenses are often vital components of a bootstrapping strategy. Streamlining operations to increase efficiency is also essential. This could involve optimizing processes, automating tasks, or outsourcing non-core functions.

Financial Management and Funding

Bootstrapping often involves carefully managing cash flow and minimizing debt. Founders need to prioritize generating revenue as quickly as possible and utilizing that revenue to fund growth and operations. This necessitates a detailed financial plan and a strong understanding of the financial implications of various business decisions. Careful budgeting and forecasting are paramount.

Bootstrapping often involves personal financial investment. Founders may need to invest their own savings or use personal credit lines to fund initial operations. This can be challenging and necessitates a realistic assessment of personal financial capacity and risk tolerance. This strategy requires careful management of personal finances and risk, and a thorough understanding of the potential risks associated with investing personal capital.

Long-Term Growth and Sustainability

While bootstrapping prioritizes self-reliance, it doesn't preclude seeking strategic partnerships or collaborations. These partnerships can provide access to new markets, resources, or expertise, potentially accelerating growth. Building strong relationships with key stakeholders is crucial for long-term sustainability.

Focusing on building a strong brand and customer loyalty is critical for long-term success. Positive customer experiences, quality products or services, and effective marketing strategies are key elements for sustained growth and profitability. This approach emphasizes building a robust customer base that values the business model and the unique value proposition.

Machine learning algorithms are fundamental to automation. These algorithms, trained on vast datasets, enable systems to learn patterns, make predictions, and automate tasks. This learning process allows systems to adapt and improve over time, becoming increasingly efficient and accurate in their performance. The algorithms themselves are diverse, encompassing supervised, unsupervised, and reinforcement learning approaches, each with its own strengths in different automation scenarios.

Venture Capital: Scaling Up with Strategic Partners

Venture Capital: Understanding the Landscape

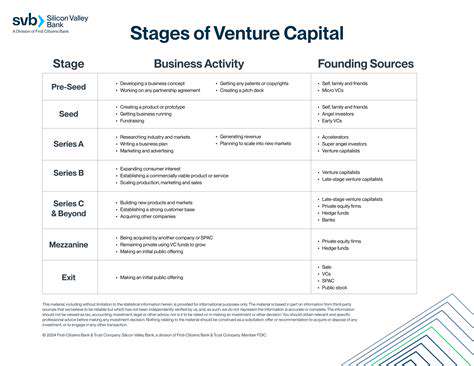

Venture capital (VC) plays a crucial role in fostering innovation and growth by providing funding to startups and early-stage companies. This funding is typically used to support research and development, product development, and market expansion. Understanding the landscape of VC involves recognizing the diverse range of investment strategies and the varying stages of companies that VC firms target.

VC firms often focus on specific sectors or industries, such as technology, healthcare, or clean energy, reflecting their expertise and investment thesis. This specialization allows them to deeply understand the market dynamics and identify promising ventures within their chosen domains. It is a complex ecosystem requiring careful navigation for both investors and entrepreneurs.

Funding Mechanisms and Investment Strategies

Venture capital funding mechanisms are diverse, ranging from seed funding to later-stage investments. Seed funding is often the initial capital injection, helping startups validate their business model and product-market fit. Subsequent rounds, such as Series A, B, and C funding, provide additional capital for scaling operations and achieving specific milestones.

Different investment strategies exist within VC firms, reflecting their unique approach to risk and return. Some firms may favor early-stage investments, while others may focus on later-stage companies with established market positions. Each approach presents unique opportunities and challenges.

The Importance of Due Diligence

Thorough due diligence is paramount in venture capital investments. This process involves a comprehensive evaluation of the startup's business model, market analysis, management team, and financial projections. Investment decisions are not made lightly; a careful assessment of these crucial factors is essential to minimize risks and maximize potential returns.

Due diligence helps identify red flags and potential roadblocks that could hinder the company's growth trajectory. This meticulous process ensures that investors are making informed decisions, safeguarding their capital and supporting promising ventures.

Exit Strategies and Returns

Exit strategies are crucial components of venture capital investments. These strategies outline how investors can realize their returns on investment. Common exit strategies include mergers and acquisitions (M&A), initial public offerings (IPOs), and secondary sales. Understanding the different exit strategies is vital for both investors and entrepreneurs to align their goals.

Challenges and Opportunities in VC

The venture capital landscape presents unique challenges, including high risk, long investment horizons, and the need for significant due diligence. Navigating these complexities requires careful planning and a thorough understanding of the market dynamics. However, the potential returns are substantial, and VC funding remains a critical driver of innovation and economic growth.

Opportunities abound in VC, but success hinges on identifying promising ventures and navigating the complexities of the market. Staying informed about industry trends and maintaining a keen understanding of market dynamics are crucial for maximizing returns.

The Role of Venture Capitalists

Venture capitalists are more than just investors; they often act as advisors and mentors to the entrepreneurs they fund. They bring valuable experience and industry insights, helping startups navigate the complexities of growth and development. This hands-on approach can significantly contribute to the success of the companies they support.

Venture capitalists play a vital role in shaping the future of innovation by providing capital and guidance. Their contributions are essential to fostering a vibrant entrepreneurial ecosystem and driving economic progress.

Read more about Best Ways to Fund Your Startup (Beyond Loans)

Hot Recommendations

- How to Stay Productive While Working Remotely

- Tips for Managing Conflict with Coworkers

- Entrance & Certification Exams (升学考试)

- How to Improve Your Storytelling Skills (Speaking)

- How to Find Profitable Side Hustles

- Tips for Preparing for the TOEFL iBT Home Edition

- Guide to Switching Careers from [Industry A] to [Industry B]

- How to Run an Effective Hybrid Meeting

- Tips for Marketing Your Side Hustle on Instagram

![Tips for Passing Your [Specific Certification Exam]](/static/images/32/2025-07/BeyondtheExam3ASustainingYourKnowledgeandGrowth.jpg)

![Best Online Courses for Learning [Specific Art Form, e.g., Painting]](/static/images/32/2025-07/AdvancedCourses3APushingCreativeBoundaries.jpg)