Guide to Calculating Profitability for a Side Hustle

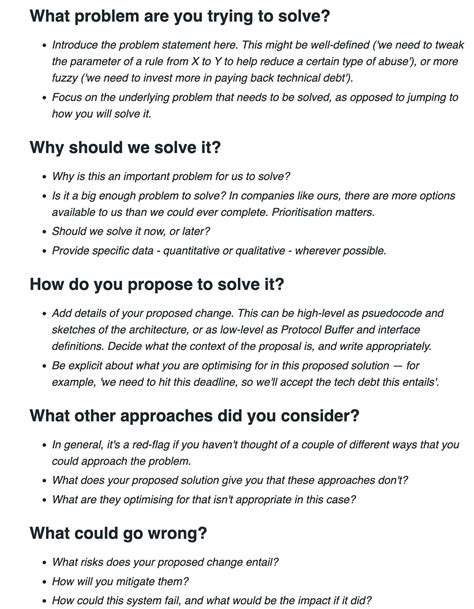

Importance of Gross Profit Margin

The gross profit margin, expressed as a percentage, provides a more insightful view of profitability than gross profit alone. It shows the percentage of revenue remaining after covering direct production costs. A higher gross profit margin indicates greater efficiency in your pricing and cost control strategies. It helps in comparing your performance against industry benchmarks and competitors. Understanding your gross profit margin is essential for financial planning and growth strategies.

Profit Margin Calculations

Profit margin, a broader profitability measure, considers all expenses, not just the direct costs of production. Net profit margin is calculated by dividing net income by total revenue. A higher net profit margin indicates improved profitability after accounting for all expenses. This metric is often used to assess overall business performance and financial health.

Factors Affecting Gross Profit

Several factors influence gross profit, including pricing strategies, production costs, and market demand. Changes in raw material costs, labor rates, and economic conditions can directly impact your COGS and, consequently, your gross profit. Understanding these factors allows for proactive adjustments in pricing and operations to maintain profitability and competitive advantage.

Interpreting Gross Profit and Margin

Analyzing your gross profit and margin figures provides valuable insights into your business's health and efficiency. Monitoring trends over time helps identify potential problems, like rising costs or declining sales. Comparing these figures to industry averages and competitors' data reveals areas for improvement and competitive positioning. Regular analysis of gross profit and margin data is essential for informed decision-making.

Using Gross Profit Data for Decision Making

Understanding your gross profit and margin data empowers you to make data-driven decisions. It helps to identify areas for cost reduction, improve pricing strategies, and optimize production processes. For example, if your gross profit margin is lower than industry standards, it signals the need for investigation into potential cost-cutting measures or strategic pricing adjustments. Ultimately, consistent monitoring and analysis of gross profit and margin are instrumental in maximizing profitability and achieving business goals.

Optimizing Your Side Hustle for Maximum Profitability

Understanding Your Costs

A crucial aspect of optimizing any side hustle for profitability is a precise understanding of your costs. This isn't just about the upfront investment, but also encompasses ongoing expenses. Consider materials, tools, software subscriptions, marketing efforts, and even the time you dedicate to the venture. Tracking these costs meticulously allows you to accurately calculate your expenses, which is essential for determining your break-even point and ultimately maximizing your profit margin. Careful cost analysis prevents you from underestimating the true financial commitment of your side hustle.

Categorizing these costs—fixed (rent, subscriptions) versus variable (materials, labor)—is also a valuable exercise. This categorization helps you anticipate fluctuating expenses and plan accordingly. Understanding your cost structure allows for better budgeting and resource allocation, ultimately leading to more informed decisions about pricing and scaling your business.

Pricing Strategies for Profit

Pricing your products or services effectively is paramount to profitability. Researching competitor pricing and understanding market value is essential. However, simply matching competitor prices is not a sustainable strategy. Factor in your unique value proposition, production costs, and desired profit margin when determining your pricing structure. Consider offering tiered pricing options to cater to different customer needs and budgets.

Value-based pricing, where you focus on the perceived value of your offering to the customer, can be particularly effective. Highlighting the benefits and advantages of your products or services over alternatives can justify a higher price point. Experiment with different pricing strategies to see what resonates best with your target market and maximizes your profitability. Don't be afraid to adjust your pricing based on market feedback and sales data.

Maximizing Efficiency and Productivity

Streamlining your workflow and maximizing efficiency are key to maximizing your side hustle's profitability. Identify bottlenecks and areas where you can automate tasks or delegate responsibilities. Utilizing time management techniques, such as prioritizing tasks and setting realistic deadlines, can dramatically increase your productivity. Investing in tools and technologies that can automate repetitive tasks can free up valuable time, allowing you to focus on higher-level activities that drive revenue.

Consider breaking down large projects into smaller, manageable tasks. This approach allows you to track progress effectively and stay motivated throughout the process. Regularly evaluating and refining your processes can lead to significant improvements in efficiency and ultimately, increased profits.

Leveraging Marketing and Sales Strategies

Effective marketing and sales strategies are crucial for driving revenue and expanding your customer base. Understanding your target market and tailoring your marketing messages to their needs is vital. Explore various marketing channels, such as social media, email marketing, content marketing, and paid advertising, to reach a wider audience. Identify the channels where your target customers are most active and focus your efforts there.

Building a strong online presence through a professional website or social media profiles is essential. Creating compelling content that educates and engages your potential customers can attract and convert them into paying clients. Leverage testimonials and case studies to build credibility and showcase the value of your side hustle.

Analyzing Your Financial Performance

Regularly analyzing your financial performance is essential to identify areas for improvement and optimize your side hustle for maximum profitability. Track your income and expenses meticulously, using spreadsheets or accounting software to monitor key metrics. Understanding your revenue streams and cost structure allows you to identify areas where you can cut costs or increase revenue. Analyze sales data to understand what's working and what isn't, and adjust your strategies accordingly.

Regularly reviewing your financial statements, such as profit and loss statements and balance sheets, helps you make informed decisions about your business's direction. Identify trends and patterns to anticipate future challenges and opportunities. Don't hesitate to seek professional financial advice if needed to ensure that your side hustle is financially sound and on track for success.