Guide to Understanding Startup Funding Options

Understanding the Concept of Bootstrapping

Bootstrapping, in the context of startups, refers to funding a business using personal resources, revenue generated from initial sales, or by securing loans from friends, family, or other private investors. This self-funding approach contrasts sharply with seeking venture capital or angel investors, relying instead on internal resources and careful financial management. This approach often involves meticulous budgeting, prioritizing expenses, and making every dollar work hard to achieve sustainable growth without external capital injections. It's a crucial strategy for entrepreneurs who want complete control over their company's destiny and direction.

The Advantages of Bootstrapping

One significant advantage of bootstrapping is maintaining complete control over the company's vision and strategy. Without external investors dictating terms, entrepreneurs can focus on their core values and strategic goals without compromise. Bootstrapping can also significantly reduce or eliminate the pressure of meeting investor expectations and quarterly earnings targets, fostering a more relaxed and focused environment for initial growth. Furthermore, it allows for a more gradual and deliberate expansion, allowing the company to learn and adapt to market conditions at its own pace, minimizing unnecessary risks.

Strategies for Bootstrapping Success

Successful bootstrapping relies on a combination of smart financial management and strategic planning. This includes meticulously tracking expenses, optimizing pricing strategies, and finding creative ways to reduce costs. Building strong relationships with suppliers and negotiating favorable terms can significantly impact the bottom line. Efficient use of resources, such as technology and marketing tools, is also crucial. Leveraging existing networks and building relationships with potential partners can also yield fruitful results.

Challenges and Considerations in Bootstrapping

Bootstrapping, while offering many advantages, presents unique challenges. Limited capital can make expansion and hiring difficult. The entrepreneur often wears multiple hats, juggling operational tasks alongside financial duties. This can create a significant workload and require immense dedication. The risk of running out of capital quickly if the initial sales targets aren't met is a constant concern. Careful planning, contingency strategies, and a realistic understanding of market conditions are vital for success.

Long-Term Growth and Exit Strategies

While the immediate focus in bootstrapping is often on survival and initial growth, long-term success requires a clear exit strategy. This may involve exploring potential acquisition opportunities or preparing for an eventual IPO. Bootstrapping can serve as a crucial foundation for building a strong, sustainable business that is attractive to potential investors in the future. While fundraising isn't the immediate goal, maintaining strong financials and a solid business model is crucial to attracting investors later on when the company is ready for growth and expansion beyond its initial bootstrapped phase.

Venture Capital (VC): Scaling Your Startup with Institutional Partners

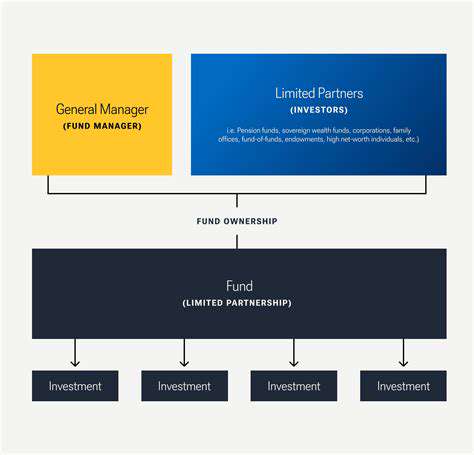

Understanding Venture Capital

Venture capital (VC) is a specialized form of private equity investment focused on funding high-growth, early-stage companies. It's a critical component of the innovation ecosystem, providing capital and expertise to entrepreneurs and startups aiming to disrupt industries and create significant market value. VC firms typically invest in companies with strong potential but limited track records, recognizing the inherent risk associated with such investments. This funding often plays a crucial role in companies' ability to scale and achieve sustainable growth.

VC firms often seek out companies with innovative ideas and strong leadership teams. They assess the market opportunity, the team's capabilities, and the financial projections to determine if the investment aligns with their investment strategy. This rigorous process helps protect their portfolio companies and ensure the long-term success of the investment.

The VC Investment Process

The VC investment process typically involves several key steps, from initial screening to final investment decisions. VC firms conduct extensive due diligence, carefully evaluating the company's financials, business model, market position, and management team. This process helps them assess the company's potential and determine if it's a worthwhile investment. Thorough due diligence is essential for mitigating risks and maximizing returns.

Thorough due diligence is crucial in the process, and it helps to minimize the risk of investment. It also ensures that the investments align with the firm's portfolio and investment strategy. This careful evaluation process is critical in making informed investment decisions.

Key Factors Driving VC Success

Several factors contribute to the success of venture capital investments. Strong management teams with proven track records are highly valued, as are innovative products or services with significant market potential. A clear and well-defined business plan, outlining the company's strategy and financial projections, is also essential for demonstrating a company's ability to execute and achieve its goals. The ability to adapt to changing market conditions and emerging trends is critical for long-term success.

Market trends and competitive landscapes play a significant role in determining the success of VC investments. Companies must adapt to these changes to maintain their competitive edge and continue to grow. A thorough understanding of market dynamics is vital for long-term viability and success.

VC's Impact on the Economy

Venture capital investments have a significant impact on the economy. They fuel innovation by providing funding for startups and small businesses. These companies often create new jobs, drive economic growth, and contribute to technological advancement. VC firms play a vital role in fostering a dynamic and innovative business environment.

Venture capital funding is essential for driving economic growth and innovation. By providing capital and expertise to promising startups, VC firms contribute to a more robust and competitive economy. This investment fuels job creation and technological advancement.

Read more about Guide to Understanding Startup Funding Options

Hot Recommendations

- How to Stay Productive While Working Remotely

- Tips for Managing Conflict with Coworkers

- Entrance & Certification Exams (升学考试)

- How to Improve Your Storytelling Skills (Speaking)

- How to Find Profitable Side Hustles

- Tips for Preparing for the TOEFL iBT Home Edition

- Guide to Switching Careers from [Industry A] to [Industry B]

- How to Run an Effective Hybrid Meeting

- Tips for Marketing Your Side Hustle on Instagram

![Best Online Courses for Learning [Specific Software, e.g., Excel]](/static/images/32/2025-07/AdvancedExcelCourses3ADataAnalysisandAutomation.jpg)