Best Online Courses for UX Writing

Practical Application and Real-World Case Studies

Practical Applications in Finance

Financial modeling serves as an indispensable tool for businesses and investors navigating complex financial landscapes. By translating raw data into actionable insights, it empowers organizations to forecast performance, evaluate investments, and quantify risks. This analytical process transforms abstract numbers into strategic roadmaps, enabling companies to allocate capital with precision and refine their financial playbooks. From startups to Fortune 500 firms, these models illuminate pathways to profitability that might otherwise remain obscured.

The versatility of financial modeling manifests across numerous business scenarios. When considering mergers, models simulate synergies and integration costs. For capital structure decisions, they project optimal debt-equity ratios under varying market conditions. What makes these applications truly powerful is their ability to convert theoretical concepts into tangible financial projections. They don't just predict outcomes - they provide decision-makers with quantifiable evidence to support critical business moves.

Real-World Examples in Business

Consider a consumer electronics company debating whether to launch a new smartwatch line. Their financial team builds a comprehensive model incorporating R&D expenditures, manufacturing costs, competitor pricing analysis, and projected adoption rates across different demographics. The model reveals that while initial margins appear slim, strategic partnerships with health insurers could create recurring revenue streams that dramatically improve long-term profitability. This insight fundamentally alters their go-to-market strategy.

Impact on Investment Decisions

Sophisticated investors rely on financial models as their analytical compass. These tools don't just crunch numbers - they contextualize them. By stress-testing assumptions against historical data and market trends, models reveal whether a startup's projected 40% annual growth aligns with industry benchmarks or defies economic gravity. The true value lies in their ability to transform subjective hunches into objective, scenario-based analyses.

During due diligence, models become forensic tools. They can detect whether a company's record profits stem from operational excellence or accounting maneuvers. When evaluating a real estate investment, they distinguish between temporary market dips and structural declines. This analytical rigor separates prudent investments from speculative gambles.

Role in Risk Management

Modern financial models function as early warning systems. A well-constructed model won't just show projected revenues - it will highlight how currency fluctuations could erode overseas profits or how supply chain disruptions might impact production costs. These models transform risk management from reactive firefighting to proactive strategy. They enable companies to establish contingency plans before crises emerge, creating financial shock absorbers for turbulent markets.

Developing Strategic Plans

Strategic planning without financial modeling resembles navigation without maps. When a retail chain considers expanding into new markets, models compare customer acquisition costs across regions, project cannibalization effects on existing stores, and evaluate various franchise versus owned-store scenarios. This analytical approach turns strategic planning from guesswork into evidence-based decision making. The models don't dictate strategy - they illuminate its financial implications.

Optimizing Resource Allocation

Resource allocation models act as corporate triage systems. They quantify how reallocating $1 million from traditional marketing to influencer partnerships might impact customer acquisition costs. They reveal whether hiring five junior analysts or two senior strategists better aligns with project pipelines. By converting qualitative decisions into quantitative trade-offs, these models bring scientific rigor to resource distribution. The result? Companies maximize ROI on every dollar invested.

The environmental impact of material choices extends beyond immediate costs. Sustainable material selection represents both ecological responsibility and long-term economic wisdom. From reduced waste disposal costs to enhanced brand reputation among environmentally-conscious consumers, the benefits compound over time. Forward-thinking businesses now evaluate materials through triple-bottom-line accounting - measuring people, planet and profit impacts.

Choosing the Right Course for Your Needs

Choosing the Right Course for Your Career

Educational investments demand the same diligence as financial ones. The ideal course doesn't just impart knowledge - it bridges the gap between your current capabilities and career aspirations. This decision requires honest self-assessment coupled with rigorous market analysis. Professionals who align their learning with industry trends and personal strengths often see compounding returns throughout their careers.

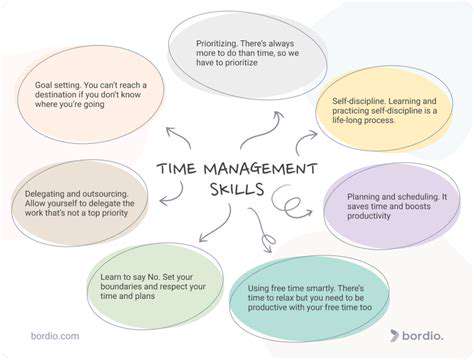

Understanding Your Career Aspirations

Career mapping should precede course selection. Aspiring data scientists might prioritize Python and machine learning, while future marketing executives may focus on consumer psychology and digital analytics. The most effective educational paths mirror the actual workflows and challenges of target roles. Industry networking and informational interviews often reveal unexpected skill requirements that should inform course choices.

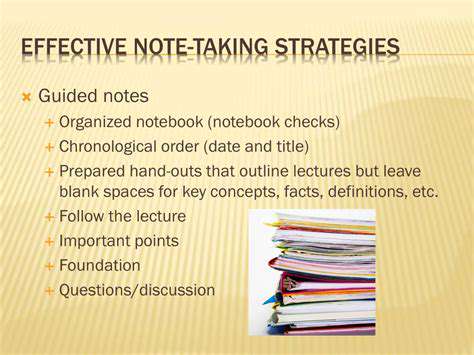

Evaluating Course Structure and Curriculum

Curriculum analysis goes beyond scanning course titles. Examine whether case studies reflect current industry challenges. Assess if technical courses include hands-on projects with real datasets. The difference between theoretical knowledge and practical competence often lies in a curriculum's applied learning components. Look for courses where at least 30% of content involves solving authentic problems.

Assessing Course Outcomes and Future Prospects

Scrutinize alumni outcomes beyond placement statistics. Investigate career trajectories five years post-completion. Do graduates advance to leadership roles? Have they published research or patented innovations? Truly transformative education creates career momentum that persists long after course completion. This longitudinal perspective reveals a program's lasting value.

Considering Budget and Time Constraints

Educational ROI calculations must account for opportunity costs. A $10,000 course requiring full-time attendance carries different implications than a $15,000 program allowing continued employment. The optimal choice balances affordability, time commitment and career impact. Many learners find that staggered programs combining online modules with intensive workshops offer the best compromise between depth and flexibility.

Read more about Best Online Courses for UX Writing

Hot Recommendations

- How to Stay Productive While Working Remotely

- Tips for Managing Conflict with Coworkers

- Entrance & Certification Exams (升学考试)

- How to Improve Your Storytelling Skills (Speaking)

- How to Find Profitable Side Hustles

- Tips for Preparing for the TOEFL iBT Home Edition

- Guide to Switching Careers from [Industry A] to [Industry B]

- How to Run an Effective Hybrid Meeting

- Tips for Marketing Your Side Hustle on Instagram

![Guide to Learning [Specific Digital Marketing Skill, e.g., Social Media Marketing]](/static/images/32/2025-06/AnalyzingandAdaptingYourSocialMediaPerformance.jpg)