Best Ways to Improve Your Decision Making Skills at Work

Understanding Diverse Options

Identifying potential options involves a comprehensive exploration of various possibilities, ranging from established solutions to innovative approaches. This initial step requires a critical eye to assess the strengths and weaknesses of each option, considering factors such as feasibility, cost-effectiveness, and long-term impact. A thorough understanding of the market, competitive landscape, and internal resources is crucial for a robust evaluation process.

We need to consider the full spectrum of choices available, not just the ones that immediately seem obvious. This includes exploring less conventional solutions and considering the potential benefits and drawbacks of each alternative. A broad perspective is key to identifying the optimal path forward.

Assessing Feasibility and Viability

Before committing to any particular option, it's essential to evaluate its feasibility and viability within the given constraints. This includes considering factors such as resource availability, time limitations, and potential risks. A realistic assessment of the challenges and obstacles is crucial for avoiding costly mistakes and ensuring the chosen option aligns with the overall goals.

Detailed planning and scenario analysis are vital for understanding the potential roadblocks that could hinder the implementation of each option. This process helps to identify potential weaknesses and develop contingency plans to mitigate risk.

Evaluating Cost-Effectiveness and Return on Investment

A crucial aspect of evaluating potential options is analyzing their cost-effectiveness and return on investment (ROI). This involves comparing the initial investment with the anticipated benefits and long-term returns. Accurate estimations of costs and benefits are essential for making informed decisions and maximizing the potential for success.

Different options may have varying upfront costs and long-term maintenance expenses. A thorough analysis of these factors is essential for making a sound investment decision.

Considering Potential Risks and Mitigation Strategies

Every potential option comes with inherent risks. A comprehensive evaluation must identify these risks and develop mitigation strategies. This includes considering potential financial losses, operational disruptions, and reputational damage. A proactive approach to risk management is crucial for minimizing potential negative impacts.

Developing contingency plans and establishing clear communication channels with stakeholders are vital for addressing potential risks effectively. Early identification and proactive risk management can significantly increase the likelihood of a successful outcome.

Analyzing Market Demand and Competitive Landscape

Understanding market demand and the competitive landscape is critical for selecting the most effective option. This involves analyzing current trends, customer preferences, and competitor activities. A thorough understanding of the market dynamics allows for a more informed decision-making process.

Considering Long-Term Impact and Sustainability

Evaluating potential options should extend beyond immediate benefits to consider their long-term impact and sustainability. This includes assessing the environmental, social, and economic consequences of each choice. A sustainable approach that considers the needs of future generations is crucial for long-term success.

Long-term viability and alignment with overarching organizational goals should be key considerations in evaluating potential options. Choosing an option that considers the future well-being of the organization and its stakeholders is critical.

Prioritizing and Selecting the Best Option

After careful evaluation of each option, it's time to prioritize and select the best one. This involves weighing the various factors discussed above, such as feasibility, cost-effectiveness, risks, and long-term impact. Clear criteria and decision-making frameworks are essential for making an objective choice.

The final decision should be based on a comprehensive analysis of all available options and a careful consideration of the overall strategic goals of the organization. This step ensures that the chosen option aligns with the long-term vision and provides the greatest potential for success.

Considering Potential Risks and Rewards: A Proactive Approach

Assessing Financial Vulnerability

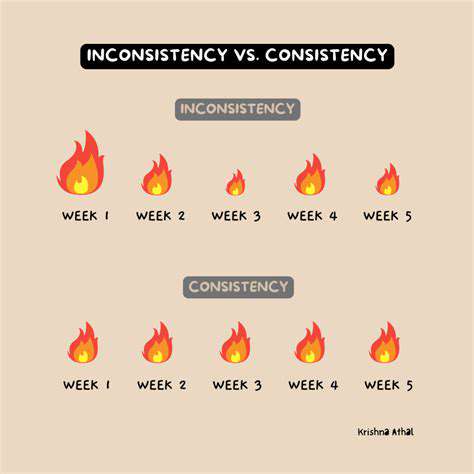

Understanding the financial health of a business is crucial for identifying potential risks. This involves a thorough analysis of current financial statements, including the balance sheet, income statement, and cash flow statement. Analyzing these statements will reveal trends and patterns that might indicate potential financial distress or opportunities for improvement. A detailed review of debt levels, revenue streams, and operational expenses is vital to gain a comprehensive understanding of the company's financial stability.

Careful consideration of liquidity, solvency, and profitability ratios is essential. These ratios provide valuable insights into the company's ability to meet its short-term and long-term obligations. Regular monitoring and analysis of these key performance indicators (KPIs) will allow proactive identification of potential financial vulnerabilities. This proactive approach will help in developing effective strategies to mitigate risks and maintain stability.

Evaluating Market Competition

The competitive landscape plays a significant role in determining the potential risks a business faces. Thorough research and analysis of competitor strategies, pricing models, and market share are essential for strategic decision-making. A detailed understanding of the competitive landscape is vital for developing effective strategies to maintain profitability and market share.

Understanding the strengths and weaknesses of competitors and analyzing their market presence and strategies can help to assess potential risks associated with market competition. This can help in identifying gaps in the market that can be exploited while simultaneously allowing for a better understanding of the competitive landscape.

Analyzing Regulatory and Legal Risks

Compliance with relevant laws and regulations is paramount for any business. A thorough review of all applicable laws and regulations is vital to ensure compliance and avoid potential legal and financial penalties.

The ever-changing regulatory landscape requires constant vigilance. Staying informed about potential changes in laws and regulations is crucial for mitigating risks. Businesses should have a clear understanding of the regulatory environment in which they operate.

Considering Operational Inefficiencies

Operational inefficiencies can lead to significant financial and reputational damage. Identifying and addressing these inefficiencies is crucial for maintaining profitability and competitiveness.

Processes and procedures should be regularly reviewed to ensure efficiency and effectiveness. Identifying and addressing bottlenecks and redundancies is essential for optimizing operations and minimizing potential risks. Streamlining processes and improving workflows can lead to substantial cost savings and enhanced productivity.

Assessing Technological Risks

The rapid pace of technological advancement creates new risks and opportunities. Adapting to technological changes is crucial for maintaining relevance and competitiveness. Staying ahead of technological advancements and adopting relevant technologies is essential for minimizing risk.

Assessing the potential impact of disruptive technologies and cybersecurity threats is vital to mitigating risks. Proactive measures are essential to ensure business continuity and prevent data breaches and other security vulnerabilities.

Identifying External Factors

External factors, such as economic downturns, natural disasters, and geopolitical instability, can significantly impact a business's operations and financial performance. Developing contingency plans and risk mitigation strategies is crucial for managing the impact of external shocks.

Analyzing potential risks and developing mitigation strategies is critical in managing the impact of external factors. Businesses must be prepared to adapt to changing circumstances and develop strategies to navigate potential disruptions. A comprehensive understanding of the external environment is critical for effective risk management.

Read more about Best Ways to Improve Your Decision Making Skills at Work

Hot Recommendations

- How to Stay Productive While Working Remotely

- Tips for Managing Conflict with Coworkers

- Entrance & Certification Exams (升学考试)

- How to Improve Your Storytelling Skills (Speaking)

- How to Find Profitable Side Hustles

- Tips for Preparing for the TOEFL iBT Home Edition

- Guide to Switching Careers from [Industry A] to [Industry B]

- How to Run an Effective Hybrid Meeting

- Tips for Marketing Your Side Hustle on Instagram

![Best Resume Templates for Career Change [2025]](/static/images/32/2025-05/EmphasizingKeywordsandIndustry-SpecificLanguage.jpg)

![How to Improve Your Memory and Retention [Techniques]](/static/images/32/2025-05/OptimizingYourLearningEnvironment3ASettingtheStageforSuccess.jpg)