Best Websites for Company Research

Financial Reporting Standards

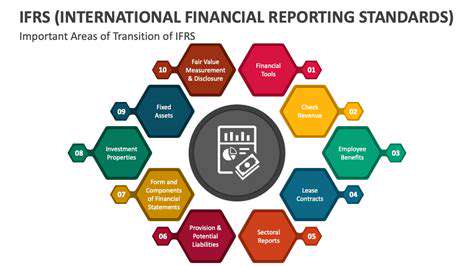

Understanding financial reporting standards remains a cornerstone for investors and stakeholders. Globally recognized frameworks such as Generally Accepted Accounting Principles (GAAP) in the US and International Financial Reporting Standards (IFRS) establish uniformity in financial statement preparation. This standardization enables apples-to-apples comparisons across companies, empowering stakeholders to make data-driven decisions. From revenue recognition to asset valuation, these guidelines ensure transparent and accurate financial disclosures.

Industry-specific variations introduce additional layers of complexity to reporting requirements. Rigorous compliance with these regulations forms the bedrock of financial market trustworthiness. Only through such adherence can investors confidently rely on financial statements when allocating capital.

Market Data Analysis

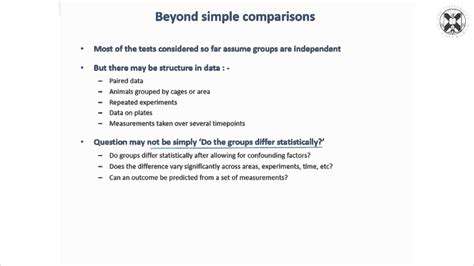

The process of market data analysis encompasses the systematic collection, processing, and interpretation of diverse market indicators. This includes not just stock prices and trading volumes, but also macroeconomic indicators and sector-specific trends. Such analysis proves indispensable for detecting market patterns, gauging investor psychology, and formulating sound investment theses.

Advanced analytical methodologies transform raw data into actionable intelligence. These sophisticated approaches enable market participants to quantify risk exposure, spot emerging opportunities, and craft robust investment strategies. When executed thoroughly, market data analysis provides a diagnostic lens into overall market vitality and trajectory.

Data Sources for Financial Reporting

The integrity of financial reporting hinges on the reliability of underlying data sources. Primary inputs include corporate financial disclosures, regulatory documents, and specialized market data services like Bloomberg Terminal and Refinitiv Eikon. The veracity of these sources directly correlates with the credibility of resulting financial analyses. Organizations must implement rigorous protocols to ensure data accuracy, completeness, and timeliness.

Triangulating information from multiple independent sources enhances analytical robustness. This multi-pronged verification approach minimizes error potential while providing a more nuanced, 360-degree market perspective. The practice also helps identify potential discrepancies that might signal deeper issues.

Impact of Reporting on Market Sentiment

Financial disclosures and market metrics exert profound influence on investor psychology. Encouraging financial results or bullish market indicators typically bolster confidence, manifesting in equity appreciation and heightened trading volumes. Conversely, disappointing news or bearish trends often triggers risk aversion and capital preservation strategies.

Market participants maintain constant vigilance over financial reports and data streams to assess portfolio implications. The market's rapid reaction to new information highlights the critical importance of both accuracy and timeliness in financial communications. This cause-and-effect relationship demonstrates how financial reporting serves as a primary driver of market behavior.

Common cold and cough can manifest through various symptoms, including nasal congestion, throat irritation, and repetitive sneezing. Early symptom recognition facilitates prompt intervention to mitigate discomfort.

General Business Information Aggregators: A One-Stop Shop for Quick Insights

Understanding the Value Proposition

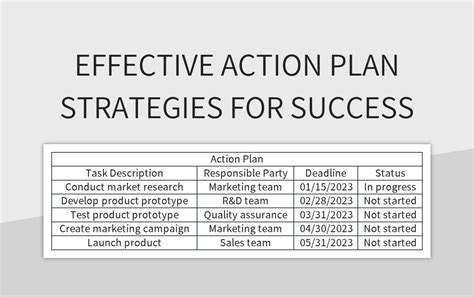

General business information aggregators deliver unique value by synthesizing disparate data streams, enabling organizations to rapidly assimilate market movements, competitive developments, and emerging prospects. This centralized approach revolutionizes research efficiency, conserving both time and operational expenses compared to manual data gathering. By offering panoramic market visibility, these platforms elevate decision-making quality and confidence.

Diverse Data Sources and Coverage

Leading aggregators curate content from an expansive ecosystem including financial disclosures, media coverage, social listening data, and trade publications. This multidimensional perspective reveals hidden correlations and emerging patterns that might escape single-source analysis. Such comprehensive coverage proves indispensable for navigating today's interconnected business landscape.

Streamlined Research and Analysis

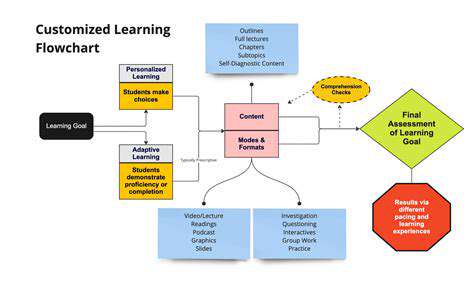

The modern information deluge threatens to overwhelm even seasoned analysts. Business aggregators counteract this by implementing intelligent data organization and visualization. Advanced filtering capabilities, personalized dashboards, and interactive data representations accelerate insight generation. This optimized workflow translates to faster, more informed business decisions.

Competitive Analysis and Benchmarking

Aggregators shine in facilitating comparative performance analysis. Users gain immediate visibility into competitor metrics, industry standards, and operational best practices. This competitive intelligence informs strategic planning, helping organizations identify improvement areas and first-mover opportunities in evolving markets.

Predictive Insights and Future Trends

Progressive platforms transcend historical data by incorporating predictive modeling and scenario forecasting. This forward-looking capability allows businesses to anticipate market shifts and position themselves advantageously. In an era of constant disruption, such prescient analysis provides critical competitive insulation.

Cost-Effectiveness and Efficiency

Compared to maintaining in-house research teams or multiple data subscriptions, aggregators offer compelling ROI. The platform approach eliminates redundant processes while maximizing intelligence yield. This operational efficiency proves particularly valuable for resource-constrained organizations seeking enterprise-grade market insights.

User-Friendly Interface and Accessibility

Effective aggregators prioritize intuitive design through logical navigation, clear data visualization, and powerful search functionality. Universal accessibility ensures democratized information flow across organizational hierarchies, fostering collaborative decision-making and institutional knowledge building.

Read more about Best Websites for Company Research

Hot Recommendations

- How to Stay Productive While Working Remotely

- Tips for Managing Conflict with Coworkers

- Entrance & Certification Exams (升学考试)

- How to Improve Your Storytelling Skills (Speaking)

- How to Find Profitable Side Hustles

- Tips for Preparing for the TOEFL iBT Home Edition

- Guide to Switching Careers from [Industry A] to [Industry B]

- How to Run an Effective Hybrid Meeting

- Tips for Marketing Your Side Hustle on Instagram

![How to Ace Your Next Job Interview [Tips & Tricks]](/static/images/32/2025-05/BeyondtheInterview3ABuildingYourNetworkandFollowingUp.jpg)