Guide to Understanding Business Insurance for Small Businesses

Key Types of Business Insurance for Small Businesses

General Liability Insurance

General liability insurance protects your business from claims of bodily injury or property damage caused by your business operations. This is a fundamental coverage, as it shields you from lawsuits stemming from accidents or incidents that occur on your premises or as a direct result of your business activities. This insurance is crucial for mitigating financial risks associated with negligence or accidental harm. It typically covers legal fees, settlements, and judgments.

Beyond the basics, general liability often includes coverage for advertising injury, which protects you if a customer claims your advertising caused them harm, such as defamation or copyright infringement. This comprehensive coverage is essential for businesses of all sizes, from sole proprietorships to large corporations.

Property Insurance

Property insurance safeguards your business's physical assets, including buildings, equipment, and inventory. This coverage is vital for replacing or repairing damaged property due to events like fire, theft, vandalism, or natural disasters. This policy protects your investment and ensures your business can continue operating even in the face of unforeseen circumstances. Specific policies may vary depending on the type of property being insured and the potential risks involved.

Different types of property insurance may be needed to cover your specific risks. For example, if you have equipment that is highly specialized or valuable, you might need specialized equipment coverage. This coverage could include replacement cost or actual cash value coverage, so it's essential to understand the specifics of your coverage.

Commercial Auto Insurance

If your business utilizes vehicles for operations, commercial auto insurance is a necessity. This coverage protects your business from liability if one of your vehicles causes an accident, leading to injuries or property damage. It covers the costs associated with defending against lawsuits, paying settlements, and covering medical expenses for injured parties. It also covers potential damages to your own vehicles.

This insurance policy is tailored to business needs, differing from personal auto insurance. It typically includes coverage for a wider range of vehicles and drivers, reflecting the specific needs of a business operation.

Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, often called errors and omissions (E&O) insurance, protects businesses from claims arising from professional mistakes or negligence in providing services. This is crucial for businesses offering professional advice or services, such as consultants, doctors, lawyers, and accountants. A significant advantage of this insurance is that it covers the legal costs and settlements in case of a lawsuit.

Workers' Compensation Insurance

Workers' compensation insurance protects your business from financial liability if an employee is injured on the job. This insurance covers medical expenses, lost wages, and rehabilitation costs for the injured employee. This type of insurance is mandated in many jurisdictions to protect both employees and employers from significant financial hardship. It is a critical element of risk management for any business with employees.

It's important to note that failing to carry workers' compensation insurance can lead to severe penalties and legal ramifications.

Cyber Liability Insurance

In today's digital world, cyber liability insurance is increasingly important. This type of insurance protects your business from risks associated with cyberattacks, data breaches, and online privacy violations. It covers the costs of data recovery, legal fees, and notification expenses in case of a cyber incident. This coverage is essential to mitigate the financial and reputational damage that can result from a cyberattack.

Business Interruption Insurance

Business interruption insurance protects your business's income if it's unable to operate due to unforeseen events like fire, flood, or a pandemic. This coverage can help your business stay afloat financially during a period of disruption. This insurance compensates for lost revenue and ongoing business expenses while operations are halted. It's particularly important for businesses that rely heavily on a consistent stream of income.

Navigating the Insurance Marketplace: Finding the Right Provider

Understanding Your Needs

Navigating the insurance marketplace can feel overwhelming, but a crucial first step is Understanding your specific needs. Consider factors like your family size, income, lifestyle, and potential future needs. Are you planning a major purchase like a home or a new car? Are there any pre-existing conditions or specific health concerns that need coverage? Analyzing these factors helps you identify the type and level of insurance you truly require.

Thorough self-assessment is key to avoiding over- or under-insurance. Overpaying for coverage you don't need can strain your budget, while inadequate coverage can leave you vulnerable to financial hardship in case of unforeseen circumstances. Take time to research different insurance options and their benefits, and don't hesitate to seek advice from financial advisors or insurance professionals.

Comparing Different Insurance Types

The insurance marketplace offers a wide range of options, from health insurance and auto insurance to home and life insurance. Each type serves a distinct purpose, providing protection against various risks. Understanding the specifics of each type is crucial for making informed decisions. Health insurance, for example, covers medical expenses, while auto insurance protects you from accidents and damages.

Comparing different insurance policies requires careful consideration of coverage details and exclusions. Don't just focus on the premiums; scrutinize the benefits, the limits, and the conditions. A policy that appears inexpensive might have hidden limitations that could significantly impact your coverage. Thorough research and comparison are essential to finding the best fit for your needs.

Researching Providers and Plans

Once you've identified your needs and the types of insurance you require, the next step is to research different providers and plans. Utilize online resources, comparison websites, and recommendations from trusted sources. Reading reviews and comparing features, such as deductibles, co-pays, and coverage limits, is crucial for a comprehensive understanding.

Evaluating Provider Reputation and Financial Stability

Beyond policy specifics, consider the reputation and financial stability of the insurance provider. A financially stable provider is more likely to be able to meet its obligations and provide consistent service. Research the provider's history, claims-paying record, and customer service ratings. Understanding how the provider handles claims and customer inquiries can significantly impact your experience.

Checking the provider's solvency rating and financial strength is also important. A strong financial standing indicates the provider's ability to meet its obligations in the long run. This aspect is particularly crucial for policies with long-term commitments, such as life insurance or long-term care insurance.

Negotiating and Making the Right Choice

After conducting thorough research, you're ready to start the negotiation process. Don't be afraid to ask questions, compare different quotes, and negotiate terms. Understanding your options empowers you to make a choice that aligns with your budget and needs. Remember, comparing various plans and providers enables you to select the best fit for your specific circumstances.

Ultimately, making the right choice involves balancing your needs with your budget and carefully considering the long-term implications of each option. Don't hesitate to seek expert advice if needed to help you navigate the complexities of the insurance marketplace.

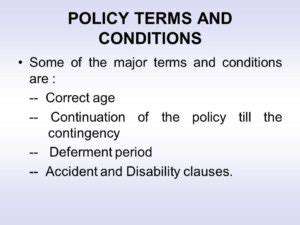

Understanding Policy Details: Key Terms and Conditions

Understanding Policy Scope

Policy documents often outline the broad scope of their application, defining the specific areas, individuals, or situations they cover. This understanding is crucial for determining whether a policy applies to a particular scenario. Policies are designed to guide behavior and resolve issues within a defined context. Understanding the boundaries of that context is paramount to interpreting the policy correctly.

Furthermore, policies frequently specify the conditions under which they are in effect. This might include time frames, geographic locations, or specific circumstances. Knowing these conditions is essential for determining the policy's validity and applicability in a given situation. A thorough review of the policy's scope and conditions is essential for proper implementation.

Interpreting Policy Language

Policy language, while often intended to be clear, can sometimes be ambiguous or contain jargon. Understanding the specific terms and phrases used is vital for accurate interpretation. Referencing definitions provided within the policy document itself or seeking clarification from the policy's authors or administrators can aid in this process. Proper understanding of the terminology is crucial to avoid misinterpretations and ensure compliance.

Technical terms or industry-specific language might require further research or clarification. Consulting external resources or seeking expert advice can be necessary in these cases. This step ensures a comprehensive understanding of the policy's nuances.

Evaluating Policy Implications

Policies often have implications that extend beyond the initial stipulations. Careful consideration of these potential consequences can help anticipate possible challenges or opportunities. This evaluation process requires considering the policy's impact on various stakeholders, including employees, customers, and the organization itself. Understanding the wider implications is critical for effectively implementing and managing the policy.

Considering potential unintended consequences is also important. A proactive approach to identifying and mitigating these issues can help ensure the policy achieves its intended goals and minimizes negative impacts.

Ensuring Policy Compliance

Implementing policies effectively requires a commitment to compliance. This encompasses understanding the policy's provisions, adhering to its procedures, and reporting any deviations or violations promptly. Clear communication and training can play a significant role in fostering compliance. Effective policy implementation relies heavily on a comprehensive understanding of the policy's requirements.

Regular reviews and updates to policies can ensure alignment with evolving needs and circumstances. Staying informed about updates is essential for maintaining compliance. Maintaining a culture of compliance is essential for the long-term success of any policy.

Read more about Guide to Understanding Business Insurance for Small Businesses

Hot Recommendations

- How to Stay Productive While Working Remotely

- Tips for Managing Conflict with Coworkers

- Entrance & Certification Exams (升学考试)

- How to Improve Your Storytelling Skills (Speaking)

- How to Find Profitable Side Hustles

- Tips for Preparing for the TOEFL iBT Home Edition

- Guide to Switching Careers from [Industry A] to [Industry B]

- How to Run an Effective Hybrid Meeting

- Tips for Marketing Your Side Hustle on Instagram

![Guide to Applying for University Scholarships [Worldwide]](/static/images/32/2025-06/DemonstratingFinancialNeed28ifapplicable293ADocumentingYourSituation.jpg)