Guide to Understanding Startup Valuation

Key Factors Influencing Startup Valuation

Market Size and Growth Potential

A crucial aspect of startup valuation is the projected market size and growth potential for the product or service. Understanding the current market and anticipating future demand is essential. A startup operating in a large, rapidly expanding market with significant unmet needs will generally command a higher valuation compared to one in a stagnant or declining market. Thorough market research, including analyzing competitors and identifying potential customer segments, is vital for accurately assessing this factor. This research should encompass not only the current market but also potential future trends that could impact demand.

Analyzing existing competitors is also critical. How many competitors are there? What are their market shares? What are their strengths and weaknesses? This analysis helps to understand the competitive landscape and the startup's potential to differentiate itself and capture market share.

Revenue Streams and Profitability

Demonstrating a clear and sustainable revenue model is paramount. A startup with multiple, diversified revenue streams, each with strong potential for growth and profitability, will be more valuable than one relying on a single, potentially fragile source. The projected revenue figures must be realistic and supported by solid market analysis, including assumptions about pricing strategies, customer acquisition costs, and potential expansion plans. A robust financial model, clearly articulated, is essential for demonstrating the potential for profitability.

Traction and Customer Acquisition

Early traction and a strong customer base signal a startup's ability to attract and retain customers. Metrics like customer acquisition costs, customer lifetime value, and customer retention rates provide valuable insights into the effectiveness of marketing and sales strategies. A startup with a proven ability to acquire and retain customers at a reasonable cost is viewed favorably by investors. Evidence of strong early adoption and positive user feedback is crucial.

Technology and Intellectual Property

The technological foundation and intellectual property (IP) of a startup are significant valuation drivers. A unique and innovative technology, a strong patent portfolio, or proprietary algorithms can provide a competitive edge and create significant value. Assessing the novelty and potential impact of the technology is essential. The level of technological advancement and its potential to disrupt the market play a major role in valuation.

The strength and protection of intellectual property (IP) are also critical. Patents, trademarks, and copyrights provide legal protection for unique technologies and innovations. The robustness of the IP portfolio and the ability to enforce it are crucial factors for investors.

Team and Management Expertise

The quality and experience of the founding team and management are crucial for success. A team with a proven track record in similar industries, strong leadership skills, and a clear understanding of the market and business model commands a higher valuation. Investors look for leadership capable of navigating challenges and driving the company towards its goals.

Competition and Market Differentiation

A detailed analysis of the competitive landscape is essential. Understanding the strengths and weaknesses of competitors and identifying a clear competitive advantage is critical. A startup that can successfully differentiate itself from its competitors by providing a unique value proposition or leveraging a superior technology will command a higher valuation. A clear understanding of how the startup will compete effectively in the market and how it will gain and maintain market share is essential.

Financial Projections and Funding Needs

Accurate financial projections, encompassing revenue forecasts, expenses, and profitability, are fundamental for investor analysis. Investors need to see a clear understanding of the startup's financial needs and a plan for achieving profitability. A realistic and well-reasoned financial model, supported by market research and realistic assumptions, is crucial. The funding needs and the use of funds must be clearly articulated.

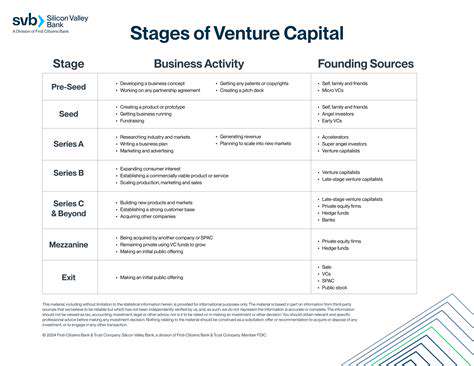

Navigating Valuation Challenges in Different Startup Stages

Understanding Valuation Fundamentals

Valuation is a crucial aspect of any investment decision, yet it's often riddled with complexities. Understanding the fundamental principles behind valuation, including discounted cash flow analysis, comparable company analysis, and precedent transactions, is essential for making informed judgments. These methods provide a framework for assessing the intrinsic value of an asset or company, allowing investors to determine if it's fairly priced or presents an opportunity for potential returns. This process involves meticulous research and analysis of financial statements, market trends, and industry dynamics.

A solid grasp of valuation principles is critical for investors to identify undervalued opportunities and avoid overpaying for assets. Failing to understand these fundamentals can lead to poor investment decisions and potentially significant financial losses. Thorough due diligence is paramount for accurate valuation assessments.

Assessing Market Conditions

Market conditions play a significant role in determining the value of an asset. Fluctuations in interest rates, economic growth, and industry-specific trends can dramatically impact valuation metrics. For example, a booming economy might inflate asset values, while a recessionary environment could depress them. Investors need to carefully consider the prevailing market context when conducting valuations.

Analyzing the specific industry environment is also critical. Factors like regulatory changes, technological advancements, and competitive pressures can all influence the valuation of assets within that specific sector. Thorough market research is essential for accurate valuation assessments, and keeping up with current events and market trends is imperative.

Analyzing Financial Statements

Financial statements provide crucial data for valuation analysis. Key metrics such as revenue, expenses, profitability, and cash flow are carefully scrutinized to determine the financial health and performance of the entity being valued. Analysts often use ratios and other financial tools to compare performance across similar companies and identify trends.

Considering Comparable Companies

Comparable company analysis involves identifying companies with similar characteristics to the subject company and examining their valuations. This process helps establish a range of reasonable valuations for the subject company. Consideration of factors like size, industry, and financial performance is essential in selecting comparable companies.

Evaluating Precedent Transactions

Analyzing precedent transactions, such as mergers and acquisitions, can provide valuable insights into the market's perception of the target company's value. By reviewing similar transactions, analysts can determine a range of valuations. Examining the terms and conditions of prior transactions helps to establish a realistic valuation benchmark. This method provides valuable context for determining the appropriate price range.

Addressing Unique Valuation Factors

Beyond the standard methodologies, certain assets or companies might present unique valuation challenges. These could include intangible assets, specialized technologies, or companies operating in emerging markets. Analysts need to carefully consider these unique circumstances and potentially develop customized valuation models. A thorough understanding of the specific factors affecting the subject company is crucial for generating an accurate valuation. Industry-specific knowledge and specialized expertise can be invaluable in these situations.

Read more about Guide to Understanding Startup Valuation

Hot Recommendations

- How to Stay Productive While Working Remotely

- Tips for Managing Conflict with Coworkers

- Entrance & Certification Exams (升学考试)

- How to Improve Your Storytelling Skills (Speaking)

- How to Find Profitable Side Hustles

- Tips for Preparing for the TOEFL iBT Home Edition

- Guide to Switching Careers from [Industry A] to [Industry B]

- How to Run an Effective Hybrid Meeting

- Tips for Marketing Your Side Hustle on Instagram

![Best Tools for Team Collaboration [2025]](/static/images/32/2025-05/StreamliningProjectManagementforEfficiency.jpg)

![Best Note Taking Apps for Effective Studying [2025]](/static/images/32/2025-08/LeveragingNote-TakingAppsforActiveRecallandReview.jpg)